Heavy weather: Last year saw a near record number of tornadoes

Active 2024 was expensive and deadly

The wild weather year that was 2024 finally ended with a parting outbreak of deadly tornadoes, but researchers will be tallying the total costs for months to come.

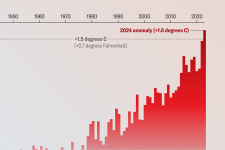

The year finished as one of the roughest in recent history for weather related disasters. The U.S. was pummeled by five landfalling hurricanes and a stream of atmospheric rivers, heat waves and droughts. That final burst of twisters is expected to make 2024 the second-worst year on record for tornadoes across the nation.

As of Dec. 31, the National Weather Service tallied 1,855 preliminary tornado reports, including 90 in December. That number will drop and the final verified numbers aren’t expected until March 1, said Harold Brooks, a senior scientist at the National Severe Storms Laboratory in Norman, Oklahoma. However, the final total is expected to be more than 1,700 tornadoes.

That would top every other year on record except 2004, when 1,817 tornadoes were confirmed, according to weather service data. The other worst tornado years on record were the 1,692 in 2008 and the 1,691 in 2011.

“We just never really got a break,” said Victor Gensini, an associate professor of meteorology and severe weather at Northern Illinois University. “There was never a significant lull in activity.”

2024 “will be the highest year for insured losses for severe convective storms – including hail, wind and tornadoes – by a large margin,” Gensini said. “We didn’t have the really large outbreaks that produced hundreds of tornadoes on a single day. We had a lot of smaller active days that aggregated day by day.”

At least 50 people died. The annual average number of deaths since 2000 is about 72.

Oklahoma, known for its tornadoes historically, had its worst year on record with 152 confirmed twisters, the weather service said. “In general, if Oklahoma is having a record year, that says something about the country,” Gensini said. At least four other states broke records for tornadoes in a single year.

The 90 preliminary tornado reports across the country in December continue a trend documented over the past 30 or 40 years, he said. “The increasing trend in the South and Southeast is something that’s been increasing, especially in the cool season.”

A particularly active jet stream, the transition from the El Niño weather pattern in the Pacific Ocean to more neutral conditions, and an exceptionally warm Gulf of Mexico have been blamed for much of the rough weather.

“When you look back in history and you’re phasing out of an El Niño and going to neutral, those years are average to above average,” Gensini said.

The Gulf of Mexico played a particular role in the cooler months, he said. “When you have a record-warm Gulf of Mexico, it’s a lot easier to transport the warm humid air that causes these types of storm events.”

Dozens of tornadoes also were a result of hurricanes making landfall.

When Hurricane Beryl made landfall in Matagorda, Texas, and its remnants moved through the northeastern U.S., it produced at least 65 tornadoes, killing at least two people. Weather service offices in Shreveport, Louisiana, and Buffalo, New York, set daily records for tornado warnings. And Hurricane Milton produced a string of more than 41 tornadoes across Florida, killing at least six people.

Digital newsstand featuring 7000+ of the world’s most popular newspapers & magazines. Enjoy unlimited reading on up to 5 devices with 7-day free trial.

www.pressreader.com