Anthropogenic global warming (AGW) has focused attention on the fossil fuel industry. AGW is so severe a danger private industry has taken the lead, leaving government behind. BUT !!

The EPA has found a new way to endanger us that makes matters orders of magnitude worse than we'd otherwise be.

Often with such alarming disclosures there's a "the other side of the story". Any idea what that might be?

The Environmental Protection Agency approved a component of boat fuel made from discarded plastic that the agency’s own risk formula determined was so hazardous, everyone exposed to the substance continually over a lifetime would be expected to develop cancer. Current and former EPA scientists said that threat level is unheard of. It is a million times higher than what the agency usually considers acceptable for new chemicals and six times worse than the risk of lung cancer from a lifetime of smoking.

Federal law requires the EPA to conduct safety reviews before allowing new chemical products onto the market. If the agency finds that a substance causes unreasonable risk to health or the environment, the EPA is not allowed to approve it without first finding ways to reduce that risk.

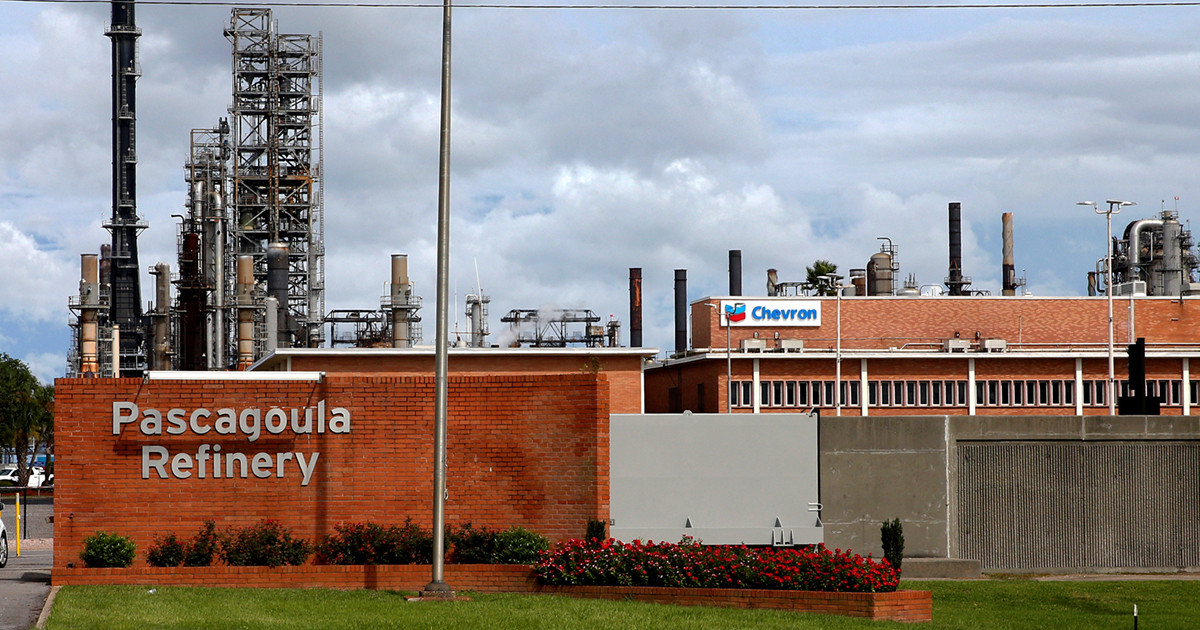

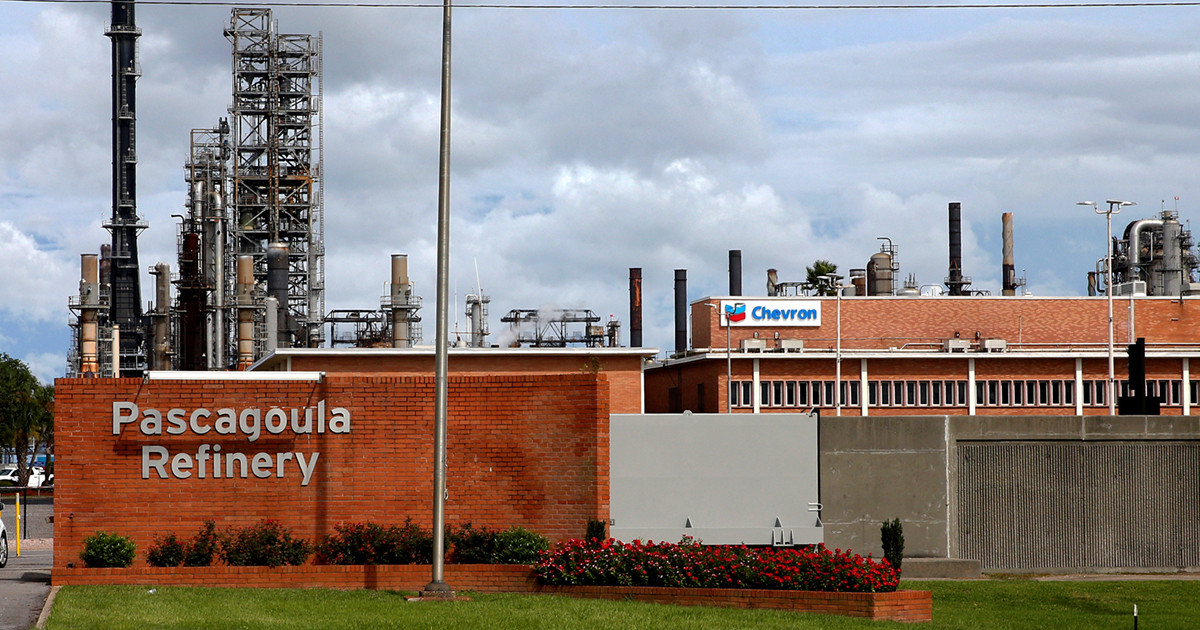

But the agency did not do that in this case. Instead, the EPA decided its scientists were overstating the risks and gave Chevron the go-ahead to make the new boat fuel ingredient at its refinery in Pascagoula, Mississippi.

www.propublica.org

www.propublica.org

Blame Biden?

Trying to kill off the boaters?

The EPA has found a new way to endanger us that makes matters orders of magnitude worse than we'd otherwise be.

Often with such alarming disclosures there's a "the other side of the story". Any idea what that might be?

The Environmental Protection Agency approved a component of boat fuel made from discarded plastic that the agency’s own risk formula determined was so hazardous, everyone exposed to the substance continually over a lifetime would be expected to develop cancer. Current and former EPA scientists said that threat level is unheard of. It is a million times higher than what the agency usually considers acceptable for new chemicals and six times worse than the risk of lung cancer from a lifetime of smoking.

Federal law requires the EPA to conduct safety reviews before allowing new chemical products onto the market. If the agency finds that a substance causes unreasonable risk to health or the environment, the EPA is not allowed to approve it without first finding ways to reduce that risk.

But the agency did not do that in this case. Instead, the EPA decided its scientists were overstating the risks and gave Chevron the go-ahead to make the new boat fuel ingredient at its refinery in Pascagoula, Mississippi.

EPA Approved a Fuel Ingredient Even Though It Could Cause Cancer in Virtually Every Person Exposed Over a Lifetime

An EPA document shows that a new Chevron fuel ingredient has a lifetime cancer risk more than 1 million times higher than what the agency usually finds acceptable — even greater than another Chevron fuel’s sky-high risk disclosed earlier this year.

Blame Biden?

Trying to kill off the boaters?